- There are 3 phases of money laundering.

- The average loss by laundered cash in one year is around $800 billion – $3 Trillion.

- Money laundering costs over $300 billion.

- Money laundering offenses are more likely to be discovered in nations like Estonia.

- By 2023, the Anti-Money Laundering Software Sector Could Reach $1.77 Billion.

- 30% of money laundering mule operators in the UK are under 21 years old.

- Only 0.1% of Money Laundering Funds Are Recovered Due to Anti-Money Laundering Activities.

- Four hundred times more fiat cash is laundered than cryptocurrency.

- Afghanistan is the nation most at risk from money-laundering activities.

- According to Estimates, global Money Laundering Costs the World Between 2% and 5% of the Global GDP.

- False positives were generated in almost 95% of system-generated money laundering changes.

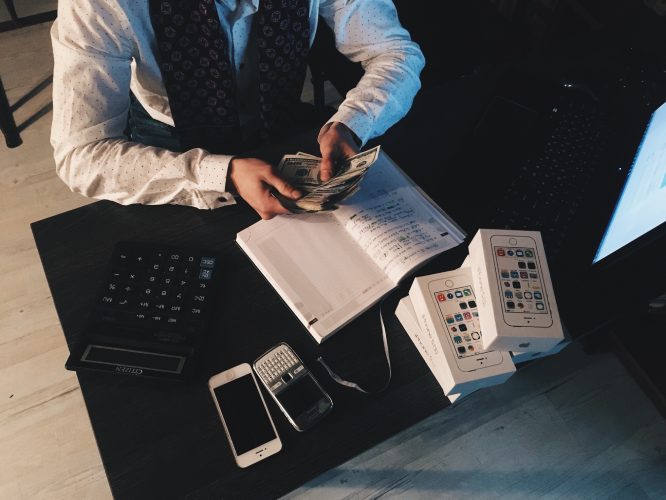

Money Laundering Happens in Three Phases.(source)

Making money that was obtained unlawfully (dirty money) appear as though it had been legitimately acquired is the act of money laundering.

These crooks can use it in that manner. Drug trafficking, financial crimes, and other illicit operations are some activities where money laundering occurs.

The money laundering process is divided into three stages:

- Placement, the money is sent to a legitimate financial system or company, such as one that accepts tiny quantities of cash.Layering, where illicit monies are covered up through transactions or bookkeeping.

- To turn dirty money into “clean cash” that may be placed into a bank account or other legitimate financial account, dirty money is passed via a small company, such as a grocery shop.

- The integration enables the “laundered” funds to be taken out and utilized as legitimate funds.

The average amount of money lost due to cash laundering in a year is between $800 billion and $3 trillion, according to a UNODC analysis. Which is 2-5% of the worldwide GDP. (source)

In the US, it is estimated that money laundering costs over $300 billion, $100 billion7 of which is through healthcare fraud. This amount of money could comfortably buy the Taj Mahal8 ($916 million) 327 times, the Empire State Building9 ($1.89 billion) 158 times, or even the Emirates Palace, costing $1 billion, 300 times.(source)

Money laundering offenses are more likely to be discovered in nations like Estonia that have minimal money laundering risks due to robust regulation, high media freedom, and enough openness. Because they have been made public, this may provide the false impression that there are more money laundering offenses in the nation. (source)

The market for anti-money laundering software might reach $1.77 billion by 2023.

The anti-money laundering market is competing to develop better methods of identifying and reducing crimes, including money laundering.(source)

There must be additional controls in place as money laundering changes and technology advances, and efficient software that can swiftly spot it.

By 2023, it is anticipated that this sector of the software market will be worth $1.77 billion. This program has been growing in popularity. In those years, such software was worth $690 million and $868 million, respectively.

30% of money laundering mule operators in the UK are under 21 years old.

Money laundering mules, often known as money mules, move illicit monies that criminals have gained illicitly. The United Kingdom’s law enforcement has noted an increase in the age of money mules. Recruiters target money mules by posting phony online job advertising aimed at Gen-Z and a few Millennials between the ages of 21 and 30. However, 30% of respondents to the advertising are younger than 21. Most of these young individuals do not know they are engaging in illegal conduct. (source)

Only 0.1% of Money Laundering Funds Are Recovered Due to Anti-Money Laundering Activities.

Despite combined international efforts, the measures used to combat money laundering operations still need to be successful. Ronald F. Pol of La Trobe University in Melbourne, Australia, and his team found that just 0.1% of the illegal cash lost to money laundering is ever recovered. Thus, these organized crime organizations, offenders, and criminals are free to utilize the money they have gained via unlawful means. As a result, despite best efforts, the global AML campaign to tackle this criminal group is failing miserably. (source)

Four hundred times more fiat cash is laundered than cryptocurrency.

Due to the difficulty of scaling up crypto laundering, fiat currency is still subject to more laundering than crypto assets. As a result, money laundering with cryptocurrencies is much less common than using conventional money. Despite this, there has been a 30% increase in bitcoin money laundering. Fiat money is laundered 400 times more frequently than bitcoin, according to a case study by Cynopsis Solutions. (source)

Afghanistan is the nation most at risk from money-laundering activities.

According to statistics, when compared to other nations, Afghanistan is the one that faces the most risk from money laundering operations. Money laundering offenses are very likely to occur in nations that lack effective monitoring of such crimes and are inactive. They do not pay attention to money laundering.(source)

According to Estimates, Global Money Laundering Costs the World Between 2% and 5% of the Global GDP.

.

The UN estimates global money laundering between $800 billion and $2 trillion annually. The cost to the global economy ranges from 2% to 5% of GDP. Gross domestic product, or GDP, is the commonly used indicator of the value created by producing goods and services in any particular nation during a specific period. The GDP is significant to the economy of any nation.(source)

False positives were generated in almost 95% of system-generated money laundering changes.

The high number of false positives is terrible news for banks and financial institutions, but it’s wonderful news for those who engage in money laundering and other financial crimes. Regarding financial crimes like money laundering, criminals get away with it while experts pursue all these false positives. Banks and other financial institutions use specialized software tools to check for questionable transactions. They are made to look for often occurring financial transactions between banks or bank accounts and abnormally high cash deposits. Despite such sophisticated technology, 95% of the warnings are false positives. (source)